Will the Russian Federation economically survive being cut-off from SWIFT?

It will be tough but possible.

How prepared is Russia to be cut-off from SWIFT? They have been planning over the last decade for a possible moment such as this. I decided to write a quick note to cover their alternatives in order to inform you of what financial architecture exists at their disposal.

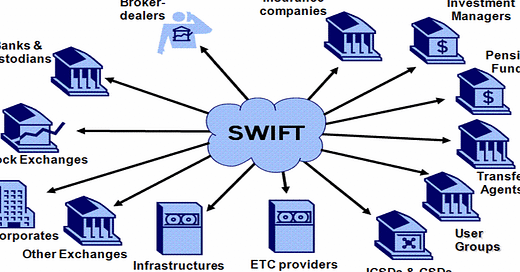

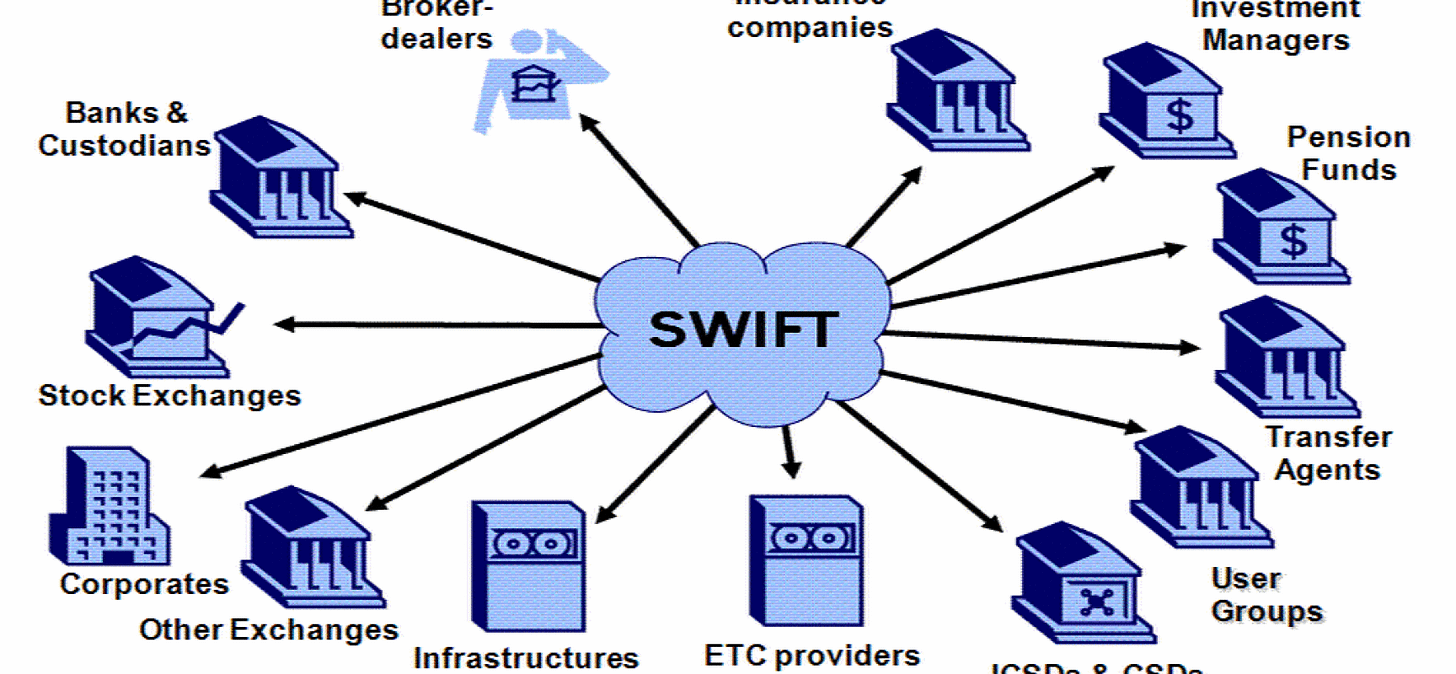

SWIFT is a vast messaging network used by banks and other financial institutions to quickly, accurately, and securely send and receive information, such as money transfer instructions. Being cut-off from this system will definitely hamper trade between both the Russian state and private business with the outside world.

The mainstream media narrative of potentially using SWIFT to put Russia in their place once and for all may end up a fallacy that fools the pubic at large into thinking it is the ‘nuclear’ financial weapon. Do not be misled to think this will stop President Putin's actions. There are alternative payment systems already up, tested and running for Russian businesses and government to conduct business internally and internationally. Here are the ones in the public domain.

1. SPFS -Russia’s System for Transfer of Financial Messages. The equivalent of SWIFT and was developed by the Central Bank of Russia since 2014, after the United States government threatened to disconnect Russia from the SWIFT system.

2. INSTEX - Instrument in Support of Trade Exchanges. This was used to facilitate legitimate trade with Iran while under sanctions in light of challenges faced by European market participants.

3. MIR -A Russian payment system for electronic fund transfers established by the Central Bank of Russia under a law adopted on 1 May 2017. Mir cards are accepted mostly by Russia-based companies, such as Aeroflot or Russian Railways, although it is gradually becoming popular among foreign companies with Russian operations.

4. Payment-versus-Payment (PVP) - is a prophylactic foreign exchange settlement mechanism that requires the simultaneous transfer of currencies for purposes of transactional security. It has been tested as a yuan-ruble payment system for financial businesses between China and Russia.

5. China’s Cross-border Interbank Payment System, CIPS - The main purpose of this system is to encourage international use of the yuan, but it also provides an alternative to the western SWIFT payment system. Russia has participated in this and encouraged the BRICS to participate in it as an extension of China’s BRI/OBOR.

6. Russia had their CBDC (Central Bank Digital Currency) under trials last month. They invited non-banking partners such as exchanges and credit institutions to the network to test the system for moments like this. There is more development and stage 2 trials this year so I'm not sure this is an immediate solution.

Let’s entertain some far-fetched unintended consequences. Russia is a major energy trading partner with Germany and Europe at large. How are Europeans going to pay for Russian commodities when Russia is cut-off from SWIFT? Can this backfire and realise the effects of already high inflation rates and supply chain issues? Will this be the spark for other nations such as China to begin ‘de-dollarization’ which has been talked about so much about by pundits of the ‘financial intellectual dark web’? Is there a point where other nations who don’t bow to the god of ‘neo-liberal globalism’ which rampant in the west, decide to push for a more multi-polar world of economics? Time will tell, stay tuned.

Keep writing, Jonathan! Your writing is well-sourced and you understand the subject matter so well. I look forward to learning more from you.