The Russian word troika means three of a kind. It can be used to refer to a sleigh drawn by three horses abreast of each other. The classic troika in the European Union comprises the Member State that is holding the Presidency of the Council, the Member State that held Presidency the previous six months and the Member State that will be holding Presidency in the future six months.

In Europe, another entity referred to as the troika fits a different description. This entity exists within Europe and has an overwhelming influence over Greece’s financial future and by extension the outlook of the euro currency. This troika consists of members from the EC (European Commission), the ECB (European Central Bank) and the IMF (International Monetary Fund). The European Commission, headed by President Jose Manuel Barroso, has 27 commissioners who implement EU policies and spend EU funds accordingly. The ECB consists of the 17 nations that use the euro and has bought bonds of the collapsing nations of “PIGS” (Portugal, Ireland, Greece and Spain). This was done in an effort to decrease borrowing rates and restore confidence in markets. Its effectiveness is yet to be seen.

In 1944 at the Bretton Woods conference in New Hampshire USA, the IMF was created to regulate trade between nations on the after effects of the Great Depression and World War II. This institution lends money to countries that are in deep financial trouble. Many speculate that the IMF’s main objective is not to help financially distressed nations but to keep them in debt so these governments will be submissive to the IMF.

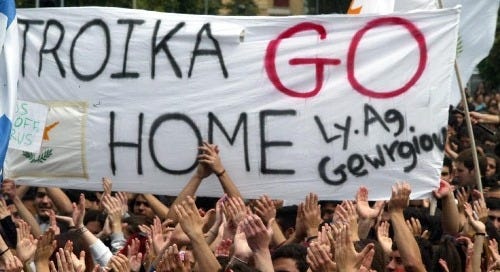

The troika mentioned here is responsible for monitoring and recommending policies to solve the present European debt crisis. In Greece the troika is meeting with the Government to make decisions on bail-out packages and austerity measures. Greece borrowed excessively in ratio to its GDP and used its revenue through taxation with poor financial discipline. When the credit crunch of 2008 unfolded with the ‘mortgage bubble’ bursting in the US, massive shock-waves were felt by countries around the world. The countries that invested in these toxic mortgage-backed securities, crumpled financially. As a result credit rating agencies downgraded countries in the following months, one of them being Greece.

One of the reasons a country gets downgraded is due to its high debt to GDP ratio. In the case of Greece it stands at 160% today. Excessively leveraged financial institutions is another reason why Greece is in the state that it is in today. Severe austerity measures on the Greek people such as pay cuts for civil workers, pension cuts and increases in taxation measures is on the way as the troika sees this as a solution but this is just ‘kicking the can down the alley’. The Greek government has to make drastic cutbacks in unnecessary spending, implement regulations and enforce these regulations on financial institutions that hold the economy hostage because they claim they are ‘too big to fail’. The bailout packages and austerity measures recommended by the troika has not restored confidence in investors as many of them are looking at other asset classes such as precious metals to hedge against the upcoming crisis.

Will Greece’s demise begin the domino effect of falling economies within the European Union?